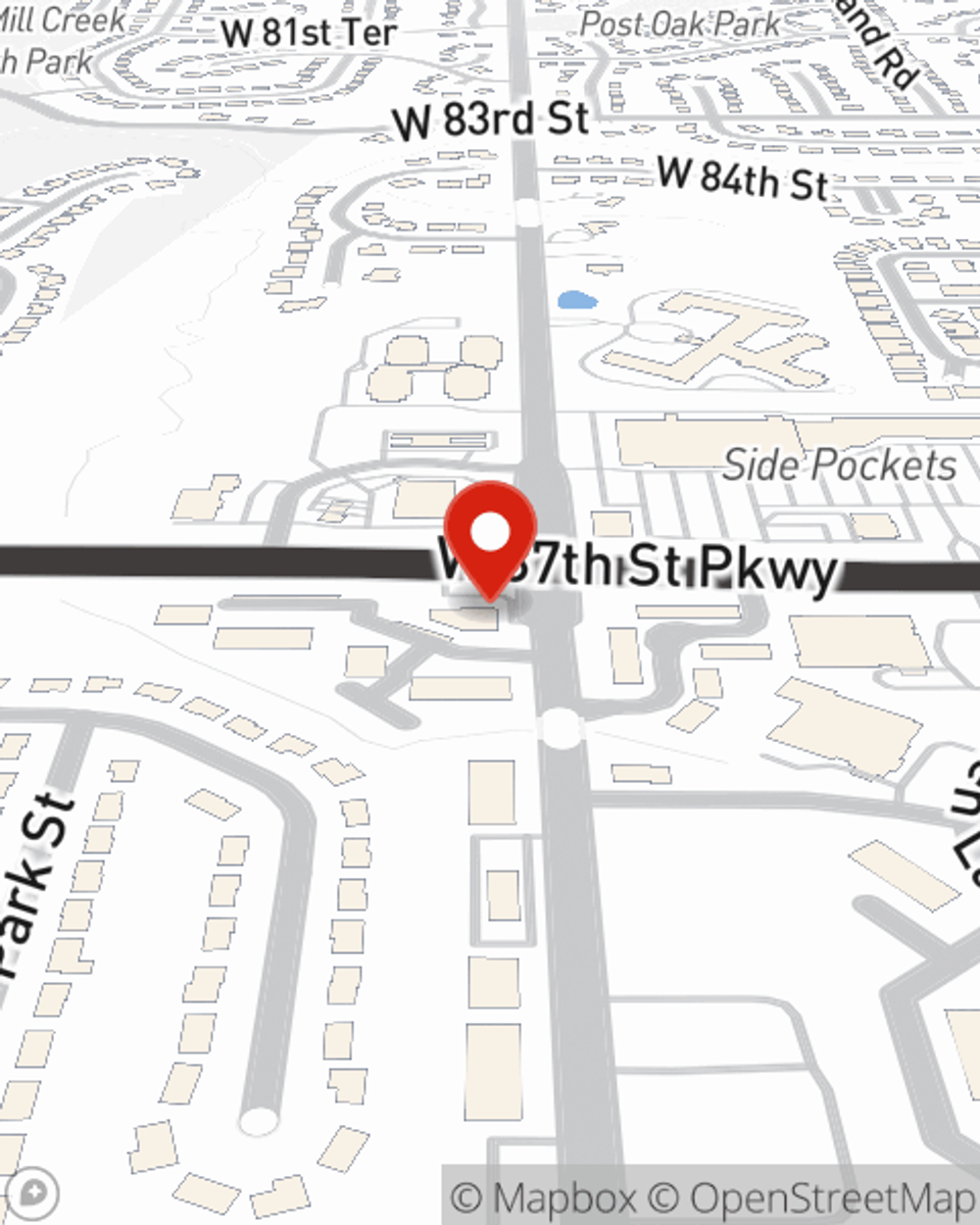

Life Insurance in and around Lenexa

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

When you're young and newly married, you may think Life insurance is only for when you get old. But it's a good time to start looking into Life insurance to prepare for the unexpected.

Coverage for your loved ones' sake

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

Coverage from State Farm helps you rest easy knowing your loved ones will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the high costs of providing for children, life insurance is an extreme necessity for young families. Even for parents who stay home, the costs of filling the void of daycare or before and after school care can be a great burden. For those who don't have children, you may have debt that your partner will have to pay or have other family members whom you help financially.

Regardless of where you're at in life, you're still a person who could need life insurance. Get in touch with State Farm agent Greg Aldridge's office to discover the options that are right for you and those you hold dear.

Have More Questions About Life Insurance?

Call Greg at (913) 492-6080 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Greg Aldridge

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.